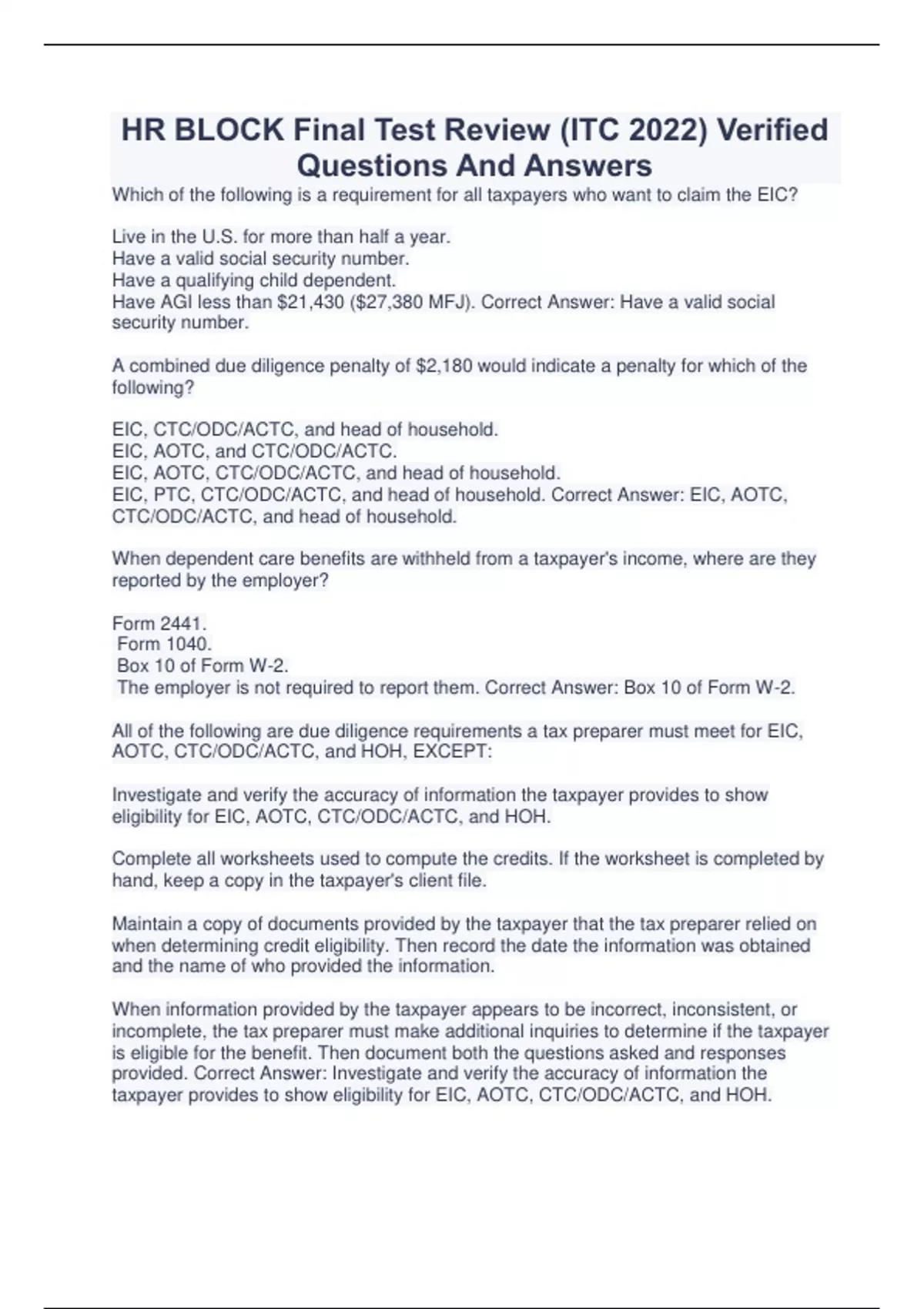

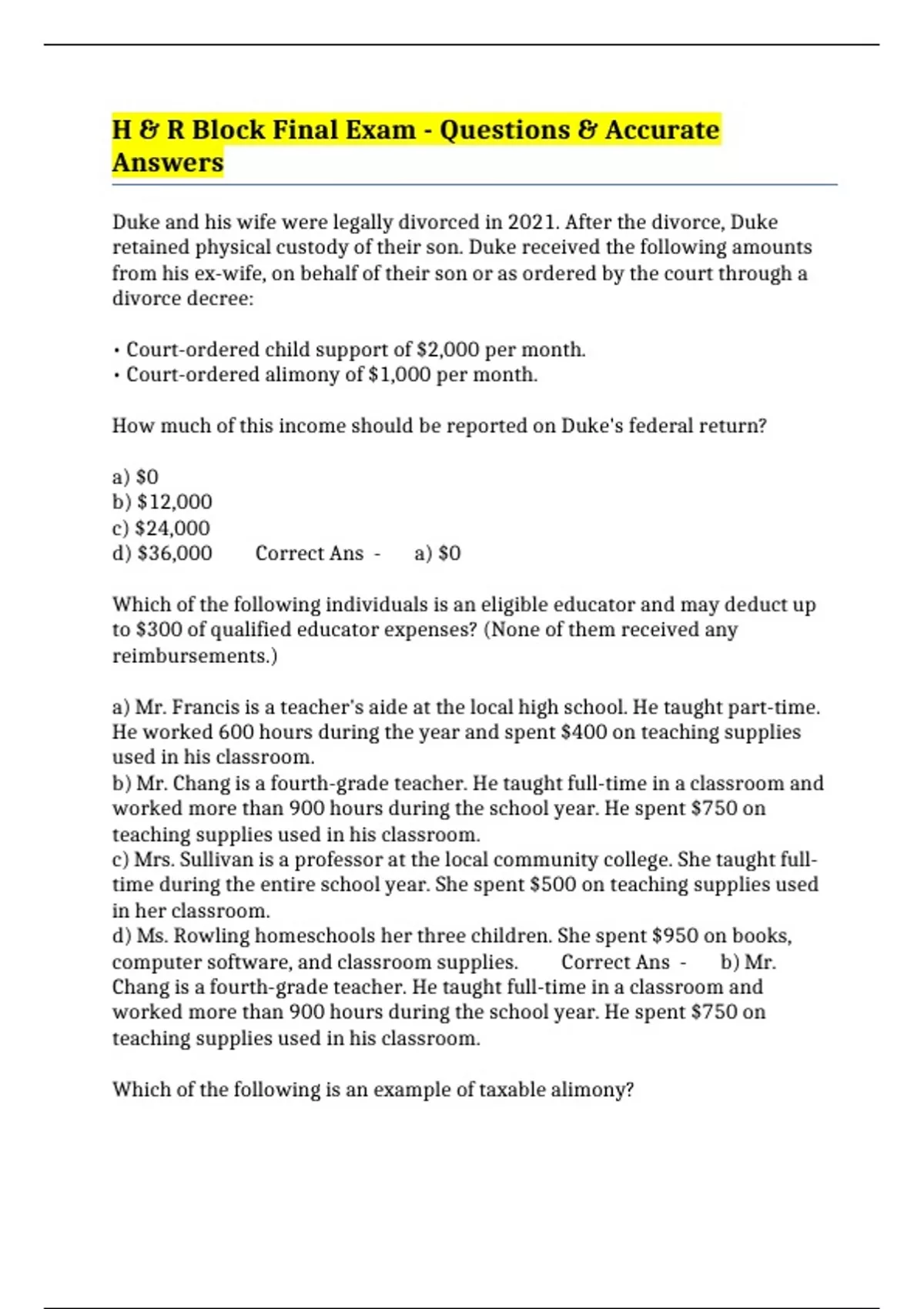

Webhe borrowed $900,000 and purchased a new main home in march of 2020. Soledad will be itemizing his deductions. On what portion of the acquisition debt will interest be deductible on soledad's tax return for 2022? Complete questions & answers (grad... Webwith these case studies, you will be able to identify the where, how, what, and how of the h&r block final exam case study answer. Some of the main characteristics of descriptive case studies include: Web3 days ago · study with quizlet and memorize flashcards containing terms like which of the following is a requirement for all taxpayers who want to claim the eic? Live in the u. s. For more than half a year. Have a valid social security number.

Related Posts

Recent Post

- Who Is Lizzy On Matts Off Road Recovery

- Mental Health Kaplan Integrated Test Quizlet

- Jefferson County Busted Newspaper

- Boost Mobile Upgrade Eligibility Check

- Credentia South Carolina

- Jobs Near Me 50k

- Tractor Supply Amoxicillin For Cats

- Tango Horoscopesabout Html

- Pa Courts State Mn

- Explore Clarion Police And Fire Calls

- Tanya Singleton Obituary 2015

- Quest Diagnostics West Linn

- Va Rating Hypertension

- Home Plans On Stilts

- Latest Obituaries Muncie Indianasupport And Help Detail Html

Trending Keywords

- 193 Clinton Ave

- Does Kroger Sell Liquor On Sunday Ohio

- Firearms Manufacturing Jobs

- Exploreclarion Obituaries

- Who Is Lizzy On Matts Off Road Recovery

- Mental Health Kaplan Integrated Test Quizlet

- Jefferson County Busted Newspaper

- Boost Mobile Upgrade Eligibility Check

- Credentia South Carolina

- Jobs Near Me 50k

Recent Search

- 7 Foot Wide Fence Gate

- Planet Fitness On

- Danger Ranger 9000 Bristol

- Kyle Neddenriep Twitter

- Man Hit By Marta Train

- Was I Supposed To Find Out Memefaq Html

- Mahn Obituaries Red Wing Mn

- Alpha Kappa Psi Secrets

- Hunting Leases In Oklahoma

- Target Rehire Policy

- Csl Plasma New Hope

- Bridgeville Police Department Facebook

- 193 Clinton Ave

- Does Kroger Sell Liquor On Sunday Ohio

- Firearms Manufacturing Jobs